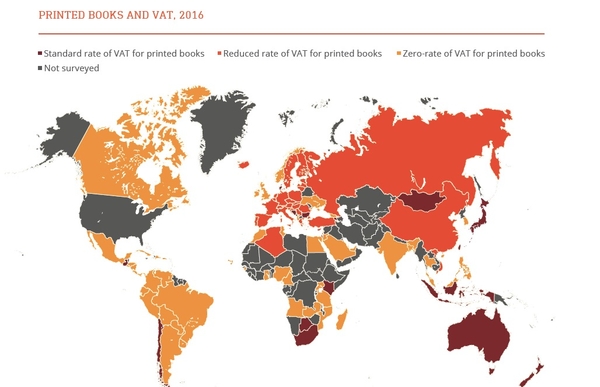

This year’s report, which can be downloaded HERE, covers 103 countries, more than ever before, and reveals the international VAT landscape when it comes to print and e-books.

Every year the IPA its European sister body the FEP field data from around the world as possible about the rate of Value Added Tax (VAT) applied to printed books and e-books in their country.

This year, the IPA and FEP received answers from 40 European countries, 15 in Asia, 19 in Africa, 20 in Latin America, six in the Middle East, plus Canada, Australia and New Zealand. The USA does not feature because each state applies an individual sales tax regime.

We asked each stakeholder for their country’s:

- Standard VAT rate

- Rate of VAT applied to print books

- Rate of VAT applied to e-books

The IPA believes that books, as a strategic commodity that activates the knowledge economy, should be exempted from VAT or subject to a zero-rate regime. There is strong evidence that exempting books from tax brings widespread medium and long-term social, cultural and economic benefits.

A zero rate of VAT on books is a fast and equitable way to boost consumption of literature in the classroom, at home and on the go. Books hold and deliver knowledge, and digital-based knowledge economies depend on the dynamic, unobstructed circulation of books.

“A zero rate of VAT on books is a fast and equitable

way to boost consumption of literature”

IPA

In all countries the book market is highly price-sensitive, which means that any increase in cost, however small, can inflict serious damage to the book chain — from the authors and publishers to distributors and retailers. For example, in Kenya a 16% VAT rate imposed in 2013 has caused nationwide book sales to fall 35%, driven down public school performances and ushered in an era in which pirated textbooks now outsell their legitimate counterparts.

In many places e-books are subject to a higher rate of VAT than printed books because they are treated as a digital ‘service’, rather than a cultural commodity, thus stunting the growth of the e-book market, especially in smaller language markets. Moreover, this discrimination penalizes people with print disabilities, many of whom rely on e-books, which are more accessible to them yet more costly due to this price differential.

In order to support the knowledge economy, to encourage reading and to promote the benefits of lifelong education, the IPA recommends zero-rate VAT for books, no matter what their format or how they are accessed.